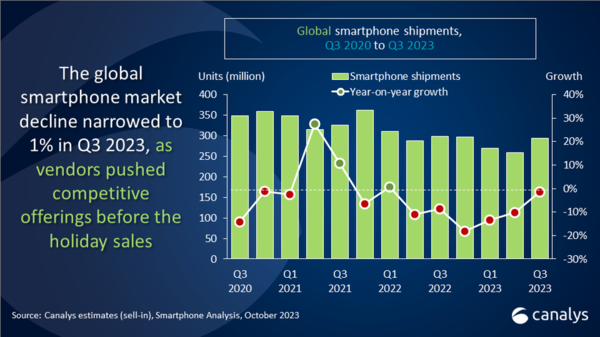

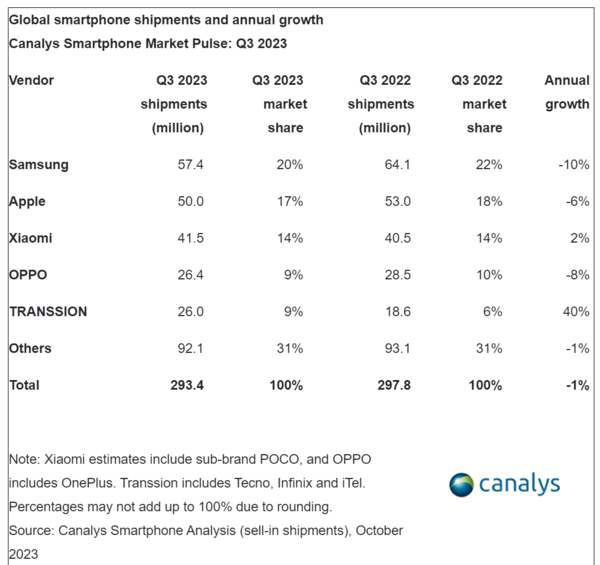

Recently reported data show that the global smartphone market fell by 1% in the third quarter of 2023, as manufacturers improved inventory in the second quarter and launched new products in the third quarter, so shipments reached 294.6 million units. Samsung topped the list with 58.6 million units shipped, with a market share of 20%. Apple, driven by demand for the new iPhone 15, followed Samsung with 50 million units shipped, giving it a 17 percent market share.

Analysts said vendors are looking for opportunities to consolidate their position in the premium market, with brands moving to strengthen their premium product lines and focusing on improving product hardware design and software UI. And believes that "under this trend, the competitive intensity of the folding screen market worldwide will continue to upgrade." Samsung released the Galaxy Z Flip and Fold 5 series two weeks earlier than in previous years, thus giving a shot in the arm for revenue and market performance in the third quarter." However, as the market supply of foldable models continues to diversify, this trend will also pose a challenge to Samsung's current dominant position in this market segment. OPPO strategically launched the Find N3 and OnePlus Open models in different regions, showing the determination of domestic manufacturers to enter the global folding screen market. In addition, the excessive differentiation between the iPhone 14 series also made Apple face demand challenges, and made it in the iPhone 15 series to lower USB-C and Smart Island to the standard model to narrow the gap, thereby stimulating demand to strengthen its position in the high-end market.

In addition to the global mobile phone market, recent data show that in the third quarter of 2023, China's smartphone market shipments of about 67.05 million units, down 6.3% year-on-year. Among them, Honor ranked first with a market share of 19.3%, an increase of 1.8% year-on-year, and the high-end market of more than 600 US dollars increased significantly with the share of three folding new products, and the thinest folding screen mobile phone was deeply popular.

OPPO followed with 16.2% market share, with the Find N3 Flip series helping OPPO to take the top spot in the vertical folding screen market. While the Reno 10 series continues to sell well to stabilize the basic market of OPPO's offline $400 to $600 price segment, OnePlus still maintains a triple-digit year-on-year growth, enhancing its competitiveness in the online $400 to $600 market.

Apple ranked third with 16.0% market share, down 4.0% year on year, mainly due to the lower-than-expected market response of the two models of iPhone 15, with more consumer demand biased towards the iPhone 15 Pro series, but could not be fully met due to supply issues.

As vivo did not release many new products in this quarter, vivo's domestic market ranked fourth in the third quarter, with a market share of 15.7%, and the market performance of vertical folding product X Flip steadily improved.

Research institutions analyzed that most manufacturers in the quarter is still conservative and cautious attitude, control shipments at the same time actively clear the channel inventory, for the next quarter of new products concentrated on the market to prepare. However, analysts pointed out that although the overall shipments in the third quarter showed a downward trend, with the launch of a number of explosive new products since August, China's smartphone market has warmed up, the attention of all sectors of society for smartphones is significantly higher than the first half of the year, consumer demand has improved, China's smartphone market shipments are expected to usher in an inflection point in the fourth quarter of 2023. It rebounded for the first time in 10 quarters.

Although the overall mobile phone consumption is relatively weak in the year, under the background of mobile phone manufacturers competing for hardware stack, it has also pulled a certain demand for replacement. This is especially reflected in the continued popularity of large memory, 1TB flash memory capacity is more and more installed in new machines, to a certain extent, driving mobile phone consumption enthusiasm.